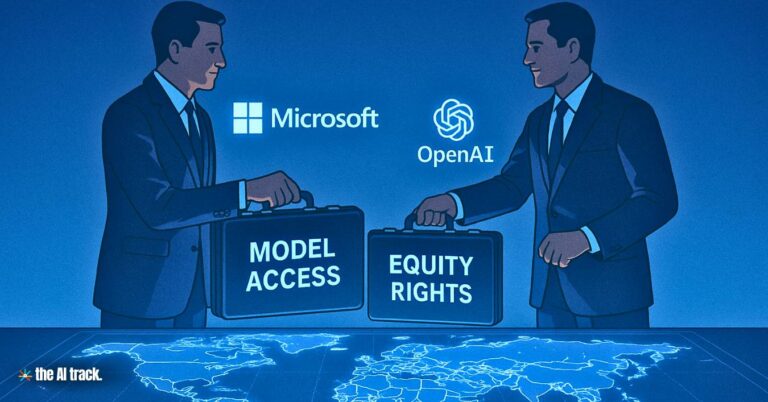

OpenAI and Microsoft are renegotiating their multibillion-dollar partnership to support OpenAI’s transition toward a Public Benefit Corporation and pave the way for a future IPO. Talks center on equity, revenue sharing, and long-term access to AI technologies, against a backdrop of increasing competition and strategic divergence between the two tech giants.

OpenAI and Microsoft Restructure Partnership – Key Points

Equity Stake Adjustments:

Microsoft has invested over $13 billion in OpenAI since their partnership began in 2019. The ongoing negotiation centers on how much equity Microsoft will retain in the new for-profit Public Benefit Corporation. Microsoft is reportedly willing to accept a smaller stake in exchange for extended access to OpenAI’s technologies developed beyond their current 2030 agreement.

Transition to Public Benefit Corporation (PBC):

OpenAI confirmed it is moving forward with restructuring into a PBC, a hybrid corporate form that allows for public-market investment while preserving its nonprofit parent’s control. Microsoft’s approval is required for this structural shift. The model aims to protect OpenAI’s mission-oriented governance while enabling IPO readiness.

Revenue Sharing Revisions:

OpenAI intends to reduce the revenue share provided to Microsoft from the current 20% to roughly 10% by 2030. This shift, reported by The Information, is part of a broader financial rebalancing meant to make OpenAI more appealing to institutional investors and viable as a publicly listed company.

Long-Term Access to AI Models:

Microsoft currently uses OpenAI technology in flagship products like Copilot and provides the compute infrastructure behind OpenAI’s services. As part of renegotiation terms, Microsoft is prioritizing continued access to future OpenAI models post-2030—even at the cost of reducing its equity stake.

Strategic Infrastructure Investments:

In January 2025, Microsoft revised its partnership with OpenAI after forming a $500 billion joint venture with Oracle and SoftBank to build AI data centers in the U.S. This Stargate project signals the deepening infrastructure commitment around AI deployment and commercialization.

Competitive Tensions & Enterprise Growth:

The Financial Times and GeekWire report that tensions have grown between the two companies due to OpenAI’s rapidly expanding enterprise business, which is increasingly seen as a rival to Microsoft’s own offerings. This rising competition complicates negotiations, even as both remain heavily reliant on each other.

Broader Partnership Renegotiation:

The companies are also updating terms from their original 2019 deal, which began with a $1 billion Microsoft investment and exclusive Azure cloud access. These legacy terms are being reevaluated to reflect today’s vastly expanded business and strategic environment.

Why This Matters:

The ongoing restructuring of the OpenAI–Microsoft partnership reflects the maturing of AI startups into major commercial players with IPO ambitions. It highlights a fundamental tension: how to attract large-scale investment while preserving the governance principles originally designed to ensure responsible AI development. Microsoft’s willingness to lower its stake in exchange for strategic access reveals how central advanced model availability has become in the AI infrastructure race. The deal’s outcome will shape not only OpenAI’s IPO trajectory but also future AI partnerships across the industry.

Microsoft is canceling AI data center investments, including 200MW of U.S. leases, while maintaining an $80B budget. Learn how this impacts the AI arms race and cloud computing.

Read a comprehensive monthly roundup of the latest AI news!