Inside the High-Stakes Race for AI Market Dominance

Jump to Sections

Introduction

Overview of the AI War: The rapid advancements in AI have sparked a fierce competition among global tech giants and ambitious startups vying for market dominance and technological supremacy.

But why should this matter to you? The answer lies in the transformative potential of AI: this battle, termed the “AI War,” holds the potential to reshape industries, redefine economic power, and change societal structures. It is not just about leading in technology; it’s about shaping the future of the world economy and influencing social dynamics.

On another level, this AI War also encompasses a broader global competition, with nations striving for AI supremacy as a matter of economic strength, national security, and geopolitical influence. This international aspect is explored in our companion analysis, “The Quest for AI Supremacy: Strategies for Global Leadership.” In this article, however, we will focus on the war among key industry players—examining the corporations that are shaping the cutting-edge of AI technology and defining its impact on our society.

The Battlefields of the AI War

The AI war is being fought on multiple fronts, with companies vying for dominance in various areas that are crucial for the development and deployment of advanced AI systems.

- AI Hardware Development

- Investments in Training AI Models

- Acquiring High-Quality Data

- AI Talent Competition

- AI Patents Competition

- Open vs. Closed AI Software Models

AI Hardware Development

One of the critical battlefields in the AI war is the development of specialized AI hardware, particularly AI chips and accelerators. These hardware components are essential for efficiently training and running complex AI models, enabling faster computation and lower energy consumption.

Companies are investing heavily in AI hardware advancements, with collaborative efforts underway to establish a standardized chip language that can facilitate seamless integration and interoperability among different AI systems. (Read related: Sam Altman’s Dream for a Network of AI Chip Factories)

Key Players

- Nvidia: Nvidia remains a dominant player in the AI hardware market, with its GPUs being crucial for AI model training and inference. The company has seen significant growth and profitability due to strong demand for its products.

- Taiwan Semiconductor Manufacturing (TSM): TSM is a leading foundry for AI chips, with its top-line jumping 13% year-over-year to $18.87 billion in the first quarter of 2024.

- Dell Technologies and Super Micro Computer: These server manufacturers are benefiting from the growing demand for AI workloads, with Dell and Supermicro stock prices jumping 184% and 847%, respectively, in the past year.

- Broadcom: Broadcom provides top-notch AI hardware and AI chips, including custom AI chips for cloud infrastructure players. The company has reported significant revenue growth and expects AI products to represent 35% of its sales this year.

- Astera Labs: Astera Labs develops connectivity chips for cloud and artificial intelligence data centers, positioning it to benefit from the ongoing proliferation of AI.

Market Trends and Developments

- AI Boom: The AI boom is driving significant growth in the semiconductor sector, with the PHLX Semiconductor Sector index gaining 51% in the past year.

- Custom Chips: Cloud companies are increasingly adopting custom AI chips to reduce costs, consume less power, and improve performance, driving demand for these specialized chips.

- Interoperability: Efforts to establish a standardized chip language will facilitate seamless integration and interoperability among different AI systems, enhancing the overall efficiency and effectiveness of AI applications.

Investments in Training AI Models

Developing advanced AI models requires significant financial and resource investments. This battlefield highlights how major companies are pouring billions into AI R&D to optimize their AI capabilities and stay ahead of competitors.

Cost of Training AI Models

The cost of training AI models can vary significantly, depending on factors such as data set size, model complexity, and computing power required. Large language models like GPT-3 can be very expensive, with estimates suggesting costs ranging from $3 million to $12 million.

OpenAI has projected that the cost of training large AI models will increase from $100 million to $500 million by 2030.

Data Requirements and Challenges

Meaningful data is crucial for training AI models in investments. Historical market data and metrics calculated from them (variances, covariances, and return distributions) are ideal for AI models due to their predictive power and tradeoff between predictive horizon and predictive power. However, the scale of necessary AI training far exceeds current capabilities, posing significant challenges for educational institutions and industry professionals.

GPU Computing Power and Cost Decline

GPU computing power for AI frontier models is growing exponentially, while the cost to train AI models is declining at an exponential rate.

This trend is expected to continue, making AI more accessible and affordable for businesses and organizations.

Key Players and Investments

- Google: Google has invested $30.7 billion in AI, leveraging its resources to improve search engines and other products like Google Assistant.

- Facebook: Facebook has invested $22.1 billion in AI, using it to enhance user experiences on its platform.

- Amazon: Amazon has invested $10 billion in AI, applying it to improve delivery services and its voice assistant, Alexa.

- Microsoft: Microsoft has invested $10 billion in AI, utilizing it for voice recognition and natural language processing.

- IBM: IBM has invested $200 billion in AI, developing its AI assistant, Watson, and improving data analysis services.

- Baidu: Baidu has invested $200 million in AI, enhancing its search engine and map services.

- Intel: Intel has invested $2 billion in AI, focusing on energy efficiency and security in electronic devices.

- Alibaba: Alibaba has invested $17 billion in AI, improving its e-commerce platform and developing its AI assistant, AliMe.

- Tencent: Tencent has invested $70 billion in AI, enhancing messaging and online gaming services.

- SAP: SAP has invested $2 billion in AI, improving data analysis services and developing its AI assistant, Leonardo.

All you need to know about the critical components of AI infrastructure, hardware, software, and networking, that are essential for supporting AI workloads.

Acquiring High-Quality Data

Importance of High-Quality Data

The quality and quantity of data used for training AI models are of paramount importance. Companies are actively seeking to acquire high-quality data from various sources, including partnerships with media companies, government agencies, and other data providers.

Key Points:

- Strategic Battleground: Data acquisition has become a strategic battleground in the AI war, with companies competing to acquire high-quality data to train their AI models.

- Partnerships and Collaborations: Companies are forming partnerships and collaborations with media companies, government agencies, and other data providers to access high-quality data.

- Data Acquisition Platforms: Companies are developing data acquisition platforms to collect and process large amounts of data from various sources.

- Data Enrichment: Companies are using data enrichment techniques to improve the quality and accuracy of their data sets.

- Data Security and Privacy: Ensuring data security and privacy will remain a top priority for companies handling sensitive data.

The AI Talent War

The competition for top AI talent is intensifying as companies seek to attract the best minds to drive their innovations. Companies are offering lucrative packages, exclusive projects, and opportunities to work on cutting-edge technology to lure top talent.

OpenAI, once a top destination for researchers, has seen a significant outflow of talent. This brain drain includes the departure of Mira Murati (former CTO), Bob McCrew, Barrett Zoph, and even foundational members like Ilya Sutskever, who was instrumental in OpenAI’s early work on deep learning and neural networks.

Challenges and Limitations

- Talent Shortage: The shortage of top AI talent is a significant challenge for companies.

- Retention: Retaining top AI talent is a challenge, as companies need to offer competitive packages and opportunities to keep them engaged.

- Diversity and Inclusion: Ensuring diversity and inclusion in the hiring process is a challenge, as companies need to attract top AI talent from diverse backgrounds.

AI Patents Competition

This battlefield is about securing intellectual property through patents. Companies are aggressively filing patents to protect their innovations and gain leverage in the AI market, making it a crucial aspect of maintaining a competitive edge.

Global Patent Leaders

- Alphabet Inc. (Google) holds the highest number of total AI patents, indicating significant investment in the field.

- Other major players include IBM, Baidu, Samsung, Amazon, and Microsoft, all with substantial AI patent portfolios.

- Chinese companies like Ping An Insurance and the Chinese Academy of Sciences are also emerging as key players in the AI patent landscape.

Patenting Trends

- There has been a fluctuating but overall increasing trend in AI patent publications from 2014 to 2023, with a 7.6% annual increase in the last three years.

- The year 2019 marked a significant milestone, with a noticeable rise in the number of AI patent publications.

- The United States, China, the European Union, and Japan lead in the number of AI patent applications filed in their respective jurisdictions.

- AI-aided patent strategies, such as using AI to assess the likelihood of patent approval, are becoming more prevalent to prioritize investments in high-potential inventions.

- Blocking patents, which prevent competitors from using certain AI technologies, are seen as an indication of high-quality AI patent portfolios.

- The rise in international patents and trademarks demonstrates that U.S. innovation leadership is not a birthright, and the country must invest in cultivating talent and developing core strategic technologies like AI.

Open vs. Closed AI Software Models

The debate between open-source and closed AI models is a key aspect of the AI War, affecting innovation, transparency, and the accessibility of AI technology. The debate around open versus closed AI software models represents a philosophical and practical battleground in the AI war, with ethical and technological implications for the future of AI development.

Open-Source AI Models

Open-source AI models offer transparency, enabling researchers and developers to scrutinize and improve upon existing models. This approach fosters collaboration, accelerates innovation, and promotes the democratization of AI technology. Open-source AI models are characterized by their availability for free distribution, copying, and modification by developers, but may pose security risks.

Closed AI Models

Closed AI models, on the other hand, offer a competitive advantage by protecting trade secrets and ensuring exclusivity. These models are typically proprietary, with the source code restricted to private use and not available for modification or alteration by users.

Hybrid Approach

Some companies adopt a hybrid approach, offering parts of their AI technology as open-source and keeping other parts proprietary.

Key Players and Notable Partnerships:

- OpenAI, Google, and Microsoft each have distinct approaches, from open-source initiatives to exclusive proprietary models, depending on strategic goals.

- Microsoft and IBM have partnered to develop AI-powered solutions, with IBM advocating for an “open science” approach to AI.

Future Outlook

- AI Innovation: The debate around open versus closed AI software models will continue to shape the future of AI innovation, with implications for the pace of development and the democratization of AI technology.

- Ethical Considerations: The ethical considerations surrounding AI development, such as data security and intellectual property, will remain a critical aspect of the debate.

- Regulatory Framework: The regulatory framework for AI development and deployment will play a crucial role in shaping the debate around open versus closed AI software models. The ethical considerations surrounding AI development, such as data security and intellectual property, will remain a critical aspect of the debate.

Explore the key differences between open source vs closed source AI, including their benefits, challenges, and implications for the future of AI

Strategic Partnerships and Collaborations

The AI war is not solely a battle between individual companies; strategic partnerships and collaborations have become a crucial aspect of the competitive landscape. Companies are recognizing the value of pooling resources, expertise, and data to accelerate AI development and gain a competitive edge.

The future of AI will be shaped by the strategic partnerships and collaborations that emerge in the coming years, and companies that fail to adapt will be left behind

Notable Partnerships

- Tech Giants: Notable partnerships in the AI industry include:

- Microsoft’s collaboration with OpenAI,

- Google’s partnership with DeepMind, and

- Amazon’s investment in Anthropic.

- Research Institutions: Collaborations with research institutions like MIT, Stanford, and Carnegie Mellon have provided access to cutting-edge research and expertise.

- Google and MIT: Google and MIT have partnered to develop AI-powered solutions for healthcare and education.

- Amazon and Stanford: Amazon and Stanford have partnered to develop AI-powered solutions for e-commerce and logistics.

- Microsoft and Carnegie Mellon: Microsoft and Carnegie Mellon have partnered to develop AI-powered solutions for cybersecurity and artificial intelligence.

- UALink Consortium Formation: UALink Consortium: Intel, Google, Microsoft, Meta, AMD, Hewlett Packard Enterprise, Broadcom, and Cisco formed the Ultra Accelerator Link (UALink) Promoter Group in Q3 2024, aimed at improving interoperability and acceleration for AI hardware.

- Startups: AI partnerships are not limited to tech giants and research institutions; startups and small businesses are also playing a significant role in the AI partnership landscape.

AI Market Growth and Economic Impact

The AI market is experiencing rapid growth, with significant economic implications for industries across the globe.

Growth Projections and Market Size

- AI Market Size: The global AI market was valued at $207.9 billion in 2023 and is projected to reach $1.8 trillion by 2030, growing at a CAGR of approximately 37.3% during this period.

- AI Training Data Market: The AI training data market is currently valued at $2.5 billion and is projected to grow to nearly $30 billion over the next decade.

- AI Software and Services: AI software and services are expected to contribute significantly to market growth, with AI-driven applications transforming industries such as healthcare, finance, retail, and manufacturing.

Impact on the U.S. Economy and Global Markets

- Impact on U.S. GDP: AI has the potential to boost the U.S. annual GDP by 0.5% to 1.5%, translating to an increase of $1.2 trillion to $3.8 trillion in real terms.

- Regional Dynamics: North America is currently the largest market for AI technology, followed closely by Asia-Pacific, which is seeing rapid adoption driven by countries like China, Japan, and South Korea.

Other Key Metrics

- Nvidia’s Dominance in AI Hardware: Nvidia holds between 80% and 95% of the AI accelerator market, underscoring its critical role in the AI ecosystem.

- AI-Powered PCs: The AI PC market has also seen significant development, with 7 million AI-powered PCs using Intel Core Ultra processors. This highlights the penetration of AI technology into consumer and professional computing.

The Leading Contenders in the AI War

OpenAI and Its Strategic Moves

OpenAI is at the forefront of AI innovation, known for its flagship product, ChatGPT. The company recently achieved a significant milestone, crossing a $1.6 billion annualized revenue rate, reflecting its strong market position and widespread adoption. This growth is attributed to the success of its paid version, ChatGPT Plus, which was launched in February 2023.

In a strategic move to outpace competitors like Google, OpenAI has introduced ChatGPT 4o (Omni), a cutting-edge AI model capable of understanding and generating content across multiple modalities, including voice, text, and images. (Read related: How OpenAI Beats Google in the Latest AI Models War.) This bold approach has allowed OpenAI to achieve significant revenue milestones and cement its position as a market leader in AI innovation.

In November 2024 OpenAI introduced ChatGPT Search – real-time web integration within ChatGPT, combining conversational AI with up-to-date, source-linked information across topics such as news, sports, weather, and stocks. This feature could mark the beginning of a new era, challenging Google’s dominance over online search.

OpenAI is closing strategic media partnerships with prominent media companies like Hearst, Condé Nast, Axel Springer, and others. By integrating high-quality journalism and curated content into AI products like ChatGPT and SearchGPT, these collaborations strengthen OpenAI’s competitive position, ensure legal compliance through proper citations, enhance content reliability, and supply quality data for training its AI models.

OpenAI has also set plans to create custom AI chips, collaborating with Broadcom and TSMC, while using AMD and NVIDIA chips in the interim. Aimed at reducing dependence on NVIDIA, the custom chips may not roll out until 2026, positioning OpenAI alongside tech giants like Google, Microsoft, and Amazon in the custom AI hardware space.

From a different POV it must be noted that OpenAI is facing a significant loss of talent amidst shifts in its strategic focus, to a for-profit structure, contrasting with its initial research-focused ethos. Despite receiving a $6.6 billion investment by the end of 2024, the departure of several key figures, including Chief Technology Officer Mira Murati, Chief Research Officer Bob McCrew, and Vice President of Research Barret Zoph, marks the continuation of a broader trend of talent leaving the organization.

Key Points:

- OpenAI’s leading product: ChatGPT

- $1.6 billion annualized revenue milestone

- Expanding market reach and influence

- ChatGPT-4o (Omni) for multimodal AI capabilities

- Strong market position and widespread adoption

- Strategic moves to outpace competitors like Google

- OpenAI is in talks with Broadcom to develop a new AI chip, underscoring the importance of specialized hardware in advancing AI capabilities.

Microsoft’s AI Ambitions with Copilot

Microsoft, a tech giant known for its software and cloud computing prowess, has made AI a top priority. The company’s integration of AI into its ecosystem, particularly with the introduction of Microsoft 365 Copilot, has garnered widespread attention.

Copilot, wants to be a powerful AI assistant in various tasks, from code generation to data analysis. By combining the power of large language models (LLMs) with Microsoft 365 apps and business data in the Microsoft Graph, Copilot aims to enhance productivity and efficiency.

Microsoft’s partnership with OpenAI has been a crucial factor in its AI ambitions. The company has invested heavily in OpenAI, committing up to $13 billion, including a $10 billion expansion announced in January 2023. This partnership has enabled Microsoft to leverage OpenAI’s cutting-edge AI models and technologies, such as ChatGPT, to enhance its own AI capabilities.

The partnership has also led to the development of new AI-powered experiences, including the Azure OpenAI Service, which empowers developers to build cutting-edge AI applications through direct access to OpenAI models backed by Azure’s trusted, enterprise-grade capabilities and AI-optimized infrastructure and tools.

Microsoft invested also $16 million in the French AI startup Mistral. This further emphasizes Microsoft’s diverse and growing AI investment portfolio.

However, Microsoft’s AI ambitions have also faced challenges, with concerns raised about the potential biases and limitations of Copilot. The company has made conscious efforts to identify and mitigate biases within Copilot’s architecture.

Nonetheless, Microsoft remains committed to advancing its AI capabilities and solidifying its position in the AI war.

Key Points:

- Integration of AI in Microsoft’s ecosystem through Microsoft 365 Copilot

- Leveraging Microsoft 365 apps and business data in the Microsoft Graph to enhance productivity

- Challenges and concerns about potential biases and limitations of Copilot

- Commitment to advancing AI capabilities and solidifying market position

- Multibillion-dollar investment in OpenAI, including a $10 billion expansion announced in January 2023.

- Microsoft announced plans to invest $3.2 billion into German AI infrastructure.

- Microsoft invested$16 million in the French AI startup Mistral.

Google’s Gemini – Market Challenges

Google, a pioneer in the field of AI, has long been a dominant force in the industry. The tech giant’s approach to AI innovation has been multifaceted, encompassing cutting-edge research, strategic partnerships, and acquisitions. Google’s Gemini project, introduced in 2023, is a testament to its commitment to AI advancements. Google’s market strategy for Gemini involves leveraging its vast resources and data access to drive AI advancements across its various products and services.

Google’s Gemini model may have been integrated across the company’s ecosystem, but user adoption and feedback have been mixed. OpenAI’s GPT-4o has raised the bar for AI models with its real-time multimodal integration, advanced language support, and user-friendly experience. GPT-4o’s superiority lies in its ability to understand and generate data across multiple modalities simultaneously, improved language support, and enhanced user experience.

Google, however, faces another challenge, this time in its core domain: search. OpenAI’s ChatGPT Search brings real-time web integration to ChatGPT, combining conversational AI with up-to-date, source-linked information on topics like news, sports, weather, and stocks. This innovation could signal the start of a new era, threatening Google’s dominance in online search as AI-driven tools like ChatGPT Search, Perplexity, and Meta’s forthcoming AI search engine offer fresh, alternative search experiences.

Despite these challenges, Google remains a formidable competitor in the AI war. The company has taken steps to address these challenges, including increasing incentives for partners driving GenAI customer wins and launching new generative AI services and delivery excellence bootcamps.

Key Points:

- Google’s innovation with the Gemini model

- Strategic partnerships and incentives for partners

- Addressing new model challenges and limitations

- Facing competition in its core domain: search

Anthropic’s Safety-First Approach

Anthropic, established in 2021 by former OpenAI executives Dario and Daniela Amodei, is dedicated to developing AI systems with a strong emphasis on safety and ethical considerations.

Anthropic’s AI Model: Claude

Anthropic’s flagship AI model, Claude, is a family of large language models (LLMs) designed to perform a wide range of tasks, including text generation, summarization, translation, and coding assistance.

Claude is developed using Anthropic’s Constitutional AI approach, which involves training the model with explicit ethical principles to ensure outputs are helpful, harmless, and honest. This framework reduces reliance on human feedback during training, enhancing scalability and consistency in ethical alignment.

Claude excels in understanding and generating human-like text, enabling it to perform complex tasks such as drafting emails, writing code, and providing detailed explanations across various subjects.

Emphasis on AI Safety and Ethics

Anthropic’s commitment to AI safety is evident through its rigorous stress-testing methodologies designed to ensure harmlessness and honesty in AI advancements. The company has implemented a Responsible Scaling Policy, pledging not to release AI models beyond certain capability thresholds without robust safety measures. This policy aims to prevent a hazardous race toward increasingly powerful AI systems without adequate safeguards.

Significant Investment from Amazon

In September 2023, Amazon announced a strategic partnership with Anthropic, committing to invest up to $4 billion. This collaboration includes Amazon becoming a minority stakeholder and Anthropic utilizing Amazon Web Services (AWS) as its primary cloud provider. The partnership aims to develop reliable and high-performing foundation models in the AI industry.

Key Points:

- Anthropic prioritizes AI safety through rigorous testing and a Responsible Scaling Policy.

- Operates as a public benefit corporation, balancing ethical considerations with business objectives.

- Secured a $4 billion investment from Amazon, highlighting a strategic focus on ethical AI development.

Amazon’s AI Strategy

Amazon’s AI strategy encompasses significant investments in infrastructure, proprietary technology development, and strategic partnerships to maintain a competitive edge in the evolving AI landscape.

Investment in AI Infrastructure

Amazon plans to invest approximately $75 billion in capital expenditures in 2024, with a substantial portion allocated to technology infrastructure, including data centers and AI-specific hardware. This investment aims to bolster Amazon Web Services (AWS) capabilities and accommodate the growing demand for AI services.

Development of Custom AI Chips

Through its subsidiary, Annapurna Labs, Amazon is developing custom AI chips to reduce reliance on external suppliers and optimize performance. The upcoming Trainium 2 chips are designed for training large AI models and are currently being tested by companies such as Anthropic, Databricks, Deutsche Telekom, and Ricoh. AWS asserts that its Inferentia chips can lower the cost of generating AI responses by 40%, offering a competitive alternative to existing solutions.

Strategic Partnerships and Investments

In September 2023, Amazon announced a collaboration with AI startup Anthropic, committing to invest up to $4 billion. This partnership aims to develop reliable and high-performing foundation models, with Anthropic utilizing AWS as its primary cloud provider.

AI-Powered Services and Applications

Amazon is integrating AI across its services to enhance customer experiences and operational efficiency. The company has introduced AI-powered shopping guides, generative AI features in Kindle Scribe, and AI tools in Prime Video for content summarization. Additionally, Amazon is leveraging AI to improve logistics and delivery processes, including the deployment of robots and AI systems in fulfillment centers to expedite operations.

Commitment to AI Education and Research

Recognizing the importance of AI education, Amazon has launched the “AI Ready” initiative, aiming to provide free AI skills training to 2 million people globally by 2025. The company is also investing in AI research collaborations, including a $25 million investment in a 10-year research partnership to advance AI technologies

Key Points:

- Amazon invested $4 billion in Anthropic to develop advanced AI models.

- The partnership includes Anthropic using AWS as its primary cloud provider.

- Amazon is integrating AI across its services to enhance customer experiences and operational efficiency.

Meta’s AI Evolution

Meta, under the leadership of Mark Zuckerberg, is making significant strides in AI integration. The company aims to incorporate AI deeply into its ecosystem, leveraging its vast social media platforms to enhance user experience and maintain a competitive edge. Unlike competitors such as OpenAI and Google, which keep their models closed and proprietary, Meta has made a strategic decision to open-source its Llama models. This move has positioned Meta as a champion of AI democratization, providing developers and businesses alike with powerful tools to innovate freely.

But Meta’s ambitions extend beyond simply improving social media experiences. CEO Mark Zuckerberg has indicated that the open-source nature of Llama doesn’t preclude it from generating revenue. Meta is positioning itself to make licensing deals with major tech players like Microsoft and Amazon, who can integrate Llama into their own services, providing Meta with a new revenue stream. As Zuckerberg stated during Meta’s third quarter earnings call, “If you’re someone like Microsoft or Amazon…we think we should get some portion of the revenue.”

Companies like Accenture, DoorDash, and Goldman Sachs have already started utilizing Llama to build their own AI solutions, highlighting its adaptability across industries ranging from consulting to finance.

This dual strategy—combining open innovation with strategic monetization—makes Meta’s approach unique in the AI war. As Gene Munster of Deepwater Asset Management pointed out, without Llama, developers would be forced to turn to alternatives like OpenAI’s GPT or Google’s Gemini.

At the same time, Meta is advancing discussions with the U.S. government (Nov 2024) to integrate its Llama AI models across public sector applications, including partnerships with the State Department and the Department of Education. This marks a significant step as Meta seeks to establish Llama as a leading AI model in U.S. government, rivaling other tech giants’ AI initiatives.

Finally, Meta is developing an AI-driven search engine to reduce its dependency on Google and Bing, which currently provide data for Meta AI across platforms like Facebook, Instagram, and WhatsApp. This strategic move places Meta in direct competition with Google, Microsoft, and OpenAI, signaling a shift toward more autonomous control over data sourcing.

Key Points:

- Strategic AI integrations at Meta

- Mark Zuckerberg’s vision for AI

- Competitive positioning against other tech giants

Perplexity and Its Unique Edge

Perplexity AI, founded in 2022 by former OpenAI researcher Aravind Srinivas, has rapidly emerged as a significant player in the AI search engine sector. Perplexity’s AI models are engineered to provide accurate and pertinent insights, utilizing sophisticated NLP techniques. A distinguishing feature is its conversational search engine, which not only generates direct answers to user queries but also cites sources within the response, enhancing transparency and user trust. This approach contrasts with traditional search engines that primarily offer a list of links.

Recent Funding and Market Expansion

In November 2024, Perplexity AI initiated a funding round aiming to raise $500 million, potentially elevating its valuation to $9 billion. This follows a significant funding round in January 2024, where the company secured $73.6 million, achieving a valuation of $520 million. Notable investors include Jeff Bezos and Nvidia, underscoring strong confidence in Perplexity’s vision and technological prowess.

The infusion of capital is intended to accelerate Perplexity’s market presence and further enhance its AI capabilities. The company has experienced substantial growth, with monthly revenues and usage increasing sevenfold since the beginning of the year. Transitioning its business model from subscriptions to advertising, Perplexity is positioning itself more directly against industry giants like Google in the $300 billion search ads market.

Key Points:

- Perplexity’s AI models offer accurate, contextually relevant responses with source citations.

- The company is in the process of raising $500 million, potentially valuing it at $9 billion.

- Transitioning to an advertising-based model to compete in the search ads market.

Explore the vital role of AI chips in driving the AI revolution, from semiconductors to processors: key players, market dynamics, and future implications.

China’s SenseTime

In the global AI war, China’s SenseTime has emerged as a formidable player, showcasing the country’s ambitions in the field of artificial intelligence. SenseTime, a leading provider of advanced AI solutions, has made significant strides in various domains, including computer vision, facial recognition, and smart city technologies.

Computer Vision and Facial Recognition

SenseTime has excelled in computer vision, becoming China’s leading provider of enterprise-level computer vision software with a substantial market share of 14% in 2020.

The company has also made significant contributions to facial recognition applications, particularly in the context of surveillance and security.

Smart City Technologies

SenseTime has been actively involved in the development of smart city technologies, leveraging its AI capabilities to enhance urban infrastructure and services. The company has pledged to help Saudi Arabia build smart cities, stimulate digital tourism, and implement surveillance infrastructure in the ambitious trillion-dollar project to build a city in the desert, NEOM.

Recent Developments and Controversies

SenseTime’s recent developments, such as the deployment of its AI-powered surveillance systems in major Chinese cities, have garnered both praise and criticism from industry observers. The company’s role in the global AI market and its strategic goals position it as a force to be reckoned with in the AI war.

Financial Performance and Challenges

SenseTime has faced significant financial challenges, including annual losses of 6.495 billion yuan in 2023 and a total loss of 50 billion yuan over the past six years.

Despite these challenges, the company has pinned its hopes on generative AI to drive profitability and has restructured its business segments to focus on this area.

Strategic Goals and Partnerships

SenseTime has formed strategic partnerships with key players in the AI industry, including Huawei and Alibaba. The company has also received significant investments from major investors like SoftBank Vision Fund and Qualcomm Ventures.

Key Points:

- Significant strides in computer vision, facial recognition, and smart city technologies

- Deployment of AI-powered surveillance systems in major Chinese cities

- Financial challenges and hopes for generative AI profitability

- Strategic partnerships and investments from major players

The Quest for AI Supremacy: Strategies for Global Leadership

The race for AI supremacy is no longer limited to a US-China rivalry. This article examines the global competition for AI leadership, analyzing strategies employed by nations like France, the UAE, and Saudi Arabia, highlighting the importance of international collaboration in shaping a beneficial AI-powered future.

Elon Musk’s xAI Initiative

Elon Musk’s xAI initiative claims to focus on responsible AI development and regulation.

The initiative has secured substantial funding to promote these goals. xAI secured $6 billion in a Series B funding round to enhance its AI product offerings, infrastructure, and research, positioning itself competitively within the AI industry. Investors include Valor Equity Partners, Vy Capital, Andreessen Horowitz, Sequoia Capital, Fidelity, and Prince Alwaleed Bin Talal. The investment raised xAI’s valuation to $18 billion, with a pre-money valuation of $18 billion.

xAI’s recent advancements include Grok-1, Grok-1.5 with long context capability, and Grok-1.5V with image understanding. The company focuses on developing truthful and competent AI systems beneficial to humanity.

Key Points:

- Significant funding for ethical AI advancements

- xAI secured $6 billion funding

- xAI’s valuation is $18 billion

Mistral AI’s Market Position

Mistral AI, a significant player in Europe, has experienced rapid growth and valuation increases. Mistral AI has been recognized as a significant competitor to established AI giants like OpenAI, Google AI, and others, marking its emergence as a formidable force in the AI landscape.

The company aims to establish itself as a leading AI innovator, leveraging its strategic growth to compete globally.

Mistral AI released its Mixtral 8x7B model, which represents a paradigm shift in AI model architecture. This model boasts a 6x faster inference rate than its competitors and demonstrates superior performance in most benchmarks compared to other models like GPT-3.5 and Llama 2.

Mistral AI introduced also Mistral Large, a general-purpose language model, and Le Chat, a sophisticated chat assistant designed to redefine conversational AI. These models position Mistral AI as a key player in the AI market and a competitor to GPT-4 and Claude

Mistral AI secured a substantial €400 million Series A funding round, which has propelled its valuation to $2 billion.

Mistral AI formed a multi-year partnership with Microsoft, which includes access to Azure’s cutting-edge AI infrastructure, accelerating the development and deployment of its next-generation large language models (LLMs).

Key Points:

- Rapid growth and increased valuation

- Strategic positioning in the global AI market

Key Points:

- Rapid growth and increased valuation

- Strategic positioning in the global AI market

NVIDIA’s Dominance in AI Hardware

Nvidia’s early and substantial investment in AI-capable chips has positioned it as a cornerstone of the AI ecosystem. Its technology underpins the capabilities of large language models and other AI-driven systems, securing its central place in the tech economy.

The company has seen an exceptional 850% growth since late 2022, underscoring its pivotal role in providing essential hardware for AI development. Nvidia’s stock has tripled in 2024 alone, demonstrating sustained investor confidence in its future prospects.

Nvidia overtook Apple (November 2024) to become the world’s most valuable company, closing at a market capitalization of $3.43 trillion compared to Apple’s $3.4 trillion, due to its dominance in the AI chip market. The AI hardware market is experiencing significant growth, with an expected annualized growth rate of almost 27%.

Nvidia is projected to nearly double its revenue in the 2025 fiscal year. Nvidia’s profit after tax nearly quadrupled in the first six months of 2024 to $31.5 billion.

In Q2 2025, four major customers accounted for 46% of Nvidia’s revenue, highlighting the strategic partnerships that drive Nvidia’s growth.

Companies like AMD and Intel are ramping up efforts in the AI hardware space, posing a potential threat to Nvidia’s market share. Concurrently, major players like OpenAI are diversifying their hardware strategy, collaborating with Broadcom for proprietary chips. This signals intensifying competition in the AI hardware sector, although Nvidia remains dominant for now.

Nvidia has recently formed strategic partnerships with major tech companies, including Google, Microsoft, Amazon, and Meta, to develop and promote alternative hardware solutions that can support the rapidly growing demands of AI and machine learning. This move aims to reduce the industry’s dependency on Nvidia’s GPUs and foster greater competition and innovation in the AI hardware market.

Key Points:

- Nvidia’s dominance in AI hardware

- Strategic partnerships and collaborations

- Market growth and future prospects

- Competition and innovation in AI hardware

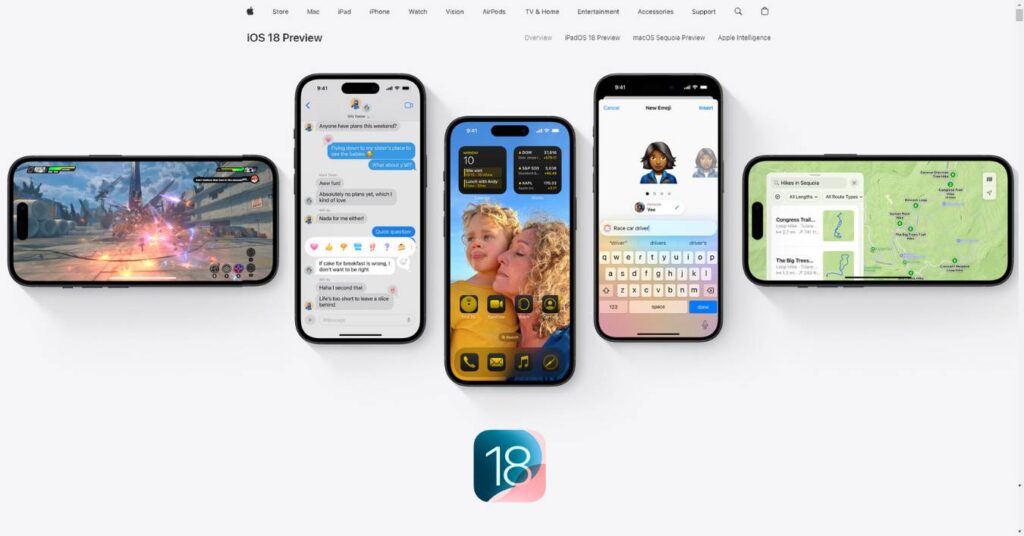

Apple’s Strategy in the AI War

Apple has strategically positioned itself as a significant player in the AI industry, focusing on enhancing its ecosystem through AI-driven services and products.

- AI Integration Across Products: Apple has been integrating AI capabilities across its products, including the iPhone, iPad, and Mac. AI powers features like Siri, Face ID, and machine learning-enhanced camera functionalities, providing a seamless user experience.

- Acquisitions and Collaborations: Apple is actively pursuing AI-related acquisitions, such as the German AI startup Bitbot, to strengthen its AI research and product offerings. These acquisitions aim to bolster its AI capabilities and maintain a competitive edge in the market.

- Privacy and Security Focus: Apple’s strategy emphasizes on-device processing for AI functions, enhancing data privacy and security. This approach differentiates Apple’s AI services from competitors that may rely heavily on cloud processing, thereby addressing privacy-conscious consumers.

- Apple AI Research: Apple has invested heavily in AI research, with its dedicated teams working on advancements in natural language processing and computer vision to further improve its products and services.

- Key Executives Leading AI Initiatives: Craig Federighi and Eddy Cue are at the forefront of Apple’s AI development, driving efforts to integrate AI across Apple’s services and maintain high standards of user privacy and innovation.

Market Outlook and Future Prospects Apple’s approach to AI emphasizes the user experience, with a focus on privacy and seamless integration across devices. The company’s investments in AI research and strategic acquisitions position it to remain a major player in the evolving AI landscape. However, Apple faces competition from other tech giants that are more aggressive in AI model development and hardware solutions.

What is Artificial Intelligence? How does it work? This comprehensive guide will explain everything you need to know in a clear and concise way.

IBM’s AI Innovations

IBM is a longstanding player in AI, with its Watson platform leading numerous innovations in healthcare, finance, and customer service.

- Leading AI Innovations with IBM Watson: IBM Watson has been at the forefront of AI innovations, driving advancements in various sectors such as healthcare, finance, and customer service.

- Focus on Enhancing Business Operations: IBM’s AI innovations are geared towards enhancing business operations by providing intelligent solutions that streamline processes, improve decision-making, and drive efficiency across various sectors.

IBM’s AI Solutions and Impact

- Healthcare: IBM’s AI solutions in healthcare have revolutionized patient care, diagnosis, and treatment planning. Watson Health, powered by AI, enables healthcare providers to make data-driven decisions, improve patient outcomes, and enhance operational efficiency.

- Finance: In the finance sector, IBM’s AI innovations have been instrumental in fraud detection, risk assessment, and personalized customer experiences.

- Customer Service: IBM’s AI solutions have transformed customer service operations by enabling personalized interactions, efficient query resolution, and enhanced customer experiences. Watson’s natural language processing and machine learning capabilities have redefined customer service standards across industries.

Baidu’s AI Leadership in China

Baidu is seen as China’s AI leader and is among the companies hoping to turn generative AI into a fresh revenue engine. Baidu’s CEO has stated that generative AI could add several billion yuan in incremental revenue for the firm in 2024.

China’s regulations have pushed Western tech companies to fully comply with the country’s rules, which has benefited Baidu as it serves many of the functions that Google does in other markets.

Baidu has rapidly advanced in AI research, increasing its presence at major AI conferences from 13% to 31% between 2010 and 2019.

AI-Powered Search Engine and Autonomous Driving

- Baidu has made significant advancements with its AI-powered search engine and autonomous driving technology.

- Baidu’s Apollo platform is a major player in the autonomous vehicle sector in China.

- Baidu’s AI-powered features have drawn some criticism and complaints from users, particularly around the accuracy and relevance of the information provided.

Partnerships and Integrations

- Baidu has reportedly won a deal to power iPhones and other Apple devices in China using its generative AI technology.

- Baidu’s AI chatbot Ernie has been integrated into Samsung’s Galaxy S24 series in China to power AI features like content summaries and translations.

In summary, Baidu has established itself as a leading AI company in China, driving advancements in search, autonomous driving, and generative AI, while also facing some challenges and controversies around its AI applications and integrations.

Intel’s AI Hardware Developments

Intel is a key player in the AI hardware market, focusing on producing chips that power AI applications and data centers.

Key Points:

- Development of AI Hardware Solutions: Intel is actively involved in developing AI hardware solutions that cater to the growing demands of AI applications and data centers. The company’s portfolio includes a range of products designed to enable high-performance and efficient AI processing.

- Strategic Acquisitions to Enhance AI Capabilities: Intel’s acquisitions of Nervana and Habana Labs are strategic moves aimed at enhancing its AI capabilities. These acquisitions have allowed Intel to expand its expertise in AI hardware technologies and strengthen its position in the competitive AI market.

Intel’s AI Hardware Portfolio

- Intel Xeon Processors: Intel’s Xeon processors are widely used in AI applications and data centers, providing the computational power needed for complex AI workloads.

- Intel® Gaudi®2 AI Hardware Accelerators: Intel’s Gaudi®2 AI hardware accelerators are designed to optimize AI processing, offering high performance and efficiency for AI workloads.

- AI Supercomputer: Intel is building a large AI supercomputer based on Intel Xeon processors and Intel® Gaudi®2 AI hardware accelerators. This initiative aims to empower developers to bring AI capabilities to various applications and industries.

Overall, Intel’s dedication to developing cutting-edge AI hardware solutions and its strategic acquisitions highlight its commitment to advancing AI technologies and strengthening its position in the competitive AI market.

Tencent’s AI Applications

Tencent, a leading technology company in China, has been actively integrating AI across its vast ecosystem, including social media, gaming, and cloud services. The company’s AI Lab focuses on AI research and applications to enhance user experience and operational efficiency.

Tencent’s cloud services also benefit from AI, with the company offering AI-powered solutions to its enterprise customers.

AI Research and Applications for Enhanced User Experience

Tencent’s AI Lab conducts fundamental and applied research to advance the state-of-the-art in AI and develop innovative applications. The company has made significant investments in AI research, hiring top experts and collaborating with leading universities and research institutes. Tencent’s AI applications aim to improve user experience by providing personalized recommendations, intelligent assistance, and enhanced content.

Key Points:

- Integration of AI in Tencent’s social media, gaming, and cloud services

- Fundamental and applied AI research conducted by Tencent’s AI Lab

- Personalized content recommendations and improved user engagement in social media

- AI-powered solutions for enterprise customers in Tencent’s cloud services

- Collaboration with top experts and research institutions to advance AI technologies

Big Tech’s Dominance in the AI Race: A Growing Concern

Since the AI race began gaining momentum at the start of 2023, concerns have emerged about the potential for a consolidation of power within the industry. Companies like Google, Amazon, Meta, and Microsoft—each valued in the hundreds of billions—have the financial and technical resources to lead in AI development. Their dominance is further entrenched through acquisitions, known as “aqui-hires,” which have seen them absorb startups like Inflection AI, Character, and Adept, effectively reducing competition before it even has a chance to mature.

The issue extends beyond mere financial muscle. Companies like Nvidia and TSMC dominate the hardware landscape, providing the chips essential for training complex AI models. Their lack of substantial competitors only strengthens Big Tech’s hold over the industry, creating a cycle where the wealthiest companies continue to gain more control.

A recent report by Mozilla and the Open Markets Institute, titled Stopping Big Tech from Becoming Big AI, highlighted how unchecked Big Tech dominance could stifle innovation, reduce consumer options, and limit the development of safer, privacy-first AI alternatives. The report recommends that governments actively enforce antitrust laws, implement strict merger controls, and mandate transparency to keep the market competitive and diverse.

The challenge isn’t just about controlling the technological aspects of AI—it’s about controlling the economic landscape that underpins AI development. As it stands, Big Tech has an outsized influence on how AI is used and who benefits from its deployment. Whether it involves deploying generative AI tools that scrape user data or integrating AI into social platforms where it’s not always wanted, Big Tech is dictating terms, and consumers often have little choice but to accept the consequences.

Regulation is seen as the only effective measure to counterbalance this power. The Mozilla report advocates for regulatory frameworks that ensure equitable access to AI technology, greater accountability in how AI models are trained, and mandatory disclosures that provide the public with insight into data usage. These measures aim to put some control back in the hands of consumers and smaller competitors, promoting a healthier, more competitive AI ecosystem.

AI War of Enterprises: Key Players

The AI industry is being shaped by a range of influential leaders across major tech companies. Here is an updated overview of the key players involved in the AI war:

- Jensen Huang: CEO of Nvidia, leading innovations in AI hardware, such as the NVLM model series and Rubin AI chip platform.

- Mustafa Suleyman: Head of Microsoft AI, previously co-founder of DeepMind, spearheading Microsoft’s AI strategy, including investments in infrastructure and partnerships.

- Mark Zuckerberg: CEO of Meta, focusing on AI integrations across Facebook, Instagram, and other Meta platforms, as well as the development of the Llama model series.

- Elon Musk: Founder of xAI, emphasizing responsible AI development with substantial Series B funding of $6 billion.

- Tim Cook: CEO of Apple, actively pursuing acquisitions and collaborations in the AI sector, including interest in the German AI startup Bitbot.

- Pat Gelsinger: CEO of Intel, focusing on AI hardware solutions, including the development of AI chips and partnerships to enhance AI infrastructure.

- David Cahn: Partner at Sequoia Capital, involved in investments in AI startups and fostering AI innovation.

- Craig Federighi and Eddy Cue: Senior executives at Apple, leading AI-powered services and software engineering, ensuring AI integration across Apple’s ecosystem.

- Brad Lightcap: COO of OpenAI, overseeing operational strategy for AI product rollouts and expanding market reach.

- Clement Delangue: CEO of Hugging Face, promoting open AI models and emphasizing collaboration in AI development.

- Mustafa Suleyman: Co-founder of Inflection AI and DeepMind, who is also playing a major role in Microsoft’s AI strategy.

- Forrest Norrod: GM of data center solutions at AMD, managing AI hardware expansion to compete with Nvidia.

- Meredith Whittaker: President of Signal, championing the ethical use of AI and user privacy.

- Gabriel Goh and James Betker: Researchers at OpenAI, contributing to AI model improvements and capabilities.

- Aiden Gomez, Nick Frost, and Ivan Zhang: Co-founders of Cohere, pushing the boundaries of natural language processing and AI research.

- Christiaan Hetzner: Journalist at Fortune, providing insights on AI developments and industry trends.

- Vaibhav (VB) Srivastav: AI enthusiast contributing to discussions on AI advancements.

- Cory Pforzheimer: Communications expert at Intel, providing strategic messaging around AI developments.

- Ian Krietzberg: Tech reporter for TheStreet, covering AI industry news and analysis.

- Josh Gartner: Head of communications at Cohere, managing public relations and media strategies for AI initiatives.

- Jack Clark: Co-founder of Anthropic, focusing on AI safety and ethical development.

- Mike Volpi: Partner at Index Ventures, investing in AI technologies and startups.

- Fei-Fei Li: Co-director of Stanford’s Institute for Human-Centered AI, advocating for ethical AI and responsible innovation.

- Bill Gurley: Venture capitalist at Benchmark, investing in AI startups and emerging technologies.

- Nick Frost and Ivan Zhang: Co-founders of Cohere, leading advancements in natural language processing.

These leaders are guiding their respective companies through a rapidly evolving competitive landscape, making critical decisions that shape the course of the AI industry.

Conclusion

The AI war is a multifaceted battle that encompasses technology, resources, talent, and strategic vision. Companies and nations alike are engaged in an intense competition to establish dominance in this field, recognizing the profound impact AI will have on virtually every aspect of human life.

As the race for AI supremacy intensifies, key battlegrounds have emerged, including investments in hardware and training models, data acquisition, strategic partnerships, and legal frameworks. The outcomes of these battles will shape the future of AI, determining which entities will wield the power to influence the trajectory of this transformative technology.

The AI war is not merely a technological competition; it is a clash of visions, ideologies, and values that will ultimately shape the future of our societies. As we navigate this uncharted territory, it is crucial to strike a balance between innovation and ethical considerations, ensuring that the development and deployment of AI systems are guided by principles of safety, transparency, and accountability.

The war for AI leadership is far from over, and its outcome will have profound implications for the world we inhabit. It is a battle that will define the contours of our future, and one that demands our collective attention and thoughtful engagement.

Key Takeaways

- OpenAI’s Leadership: OpenAI is a leading AI innovator, highlighted by its $1.3 billion annualized revenue and flagship product, ChatGPT.

- Microsoft and Google: Microsoft’s Copilot and Google’s Gemini are central to their AI strategies, though both face significant competition and challenges.

- Amazon and Anthropic: Amazon’s $4 billion investment in Anthropic underscores its commitment to AI safety and innovation.

- AI Talent War: The competition for top AI talent is intensifying, with companies offering lucrative incentives to attract skilled professionals.

- AI Patents Competition: Companies are aggressively filing AI patents to protect innovations and maintain a competitive edge.

- Global AI Competition: The USA, China, Russia, and France are key players in the global AI race, with national strategies significantly influencing the market.

- Strategic Partnerships: Collaborative efforts in AI development are essential, driving innovation and market advantages.

- Legal and Ethical Challenges: Content and copyright disputes highlight the complexities of AI regulation and ethical considerations.

- Financial Investments: The high costs of AI development require balancing investments with market demand to achieve sustainable growth.

Read a comprehensive monthly roundup of the latest AI news!