Meta plans $65B AI investment for 2025, including a Manhattan-sized data center and next-gen Llama models, as CEO Mark Zuckerberg warns of industry-wide overinvestment risks while prioritizing long-term dominance.

Meta Plans $65B AI Investment for 2025 – Key Points

Revised 2025 AI Budget: Meta plans $65B AI investment for 2025

Meta’s 2025 AI budget has increased to $65 billion (up from $60 billion in prior announcements), with capital expenditures projected to rise 50% over 2024’s estimated $40 billion and more than double 2023’s spending. The investment includes:

- 1.3 million Nvidia GPUs (up from 350K in 2024), critical for training Llama 4

- A $10B Louisiana data center (size: “significant part of Manhattan”)

- 1 gigawatt compute capacity (powering 750K homes annually)

- expanded AI team hiring.

Infrastructure Scale: 1.3M GPUs & 1 Gigawatt Compute

The company will deploy 1 gigawatt of computing power in 2025—equivalent to the annual energy consumption of 750,000 U.S. households—and expand its GPU fleet to 1.3 million units, up from 350,000 Nvidia H100 GPUs acquired in 2024. This infrastructure will power Meta AI (targeting 1+ billion users) and the Llama 4 model.

Louisiana Data Center: $10B “Manhattan-Sized” Facility

The Richland Parish, Louisiana, data center (population: ~19,000) will occupy an area comparable to “a significant part of Manhattan” and serve as Meta’s AI R&D hub. Zuckerberg confirmed the project will support development of an “AI engineer” tool to automate code generation for internal projects.

Labor & Sustainability Challenges

The Louisiana facility is expected to create “hundreds” of high-skilled jobs, but critics question whether rural areas can attract sufficient talent.

The 1-gigawatt energy demand also raises concerns about Meta’s renewable energy commitments, as the company aims for net-zero emissions by 2030.

Strategic Hiring Surge

Meta will “grow AI teams significantly” in 2025, focusing on generative AI, hardware optimization, and ethics. This follows a 15% increase in AI-related job postings in Q4 2024, per Bloomberg data.

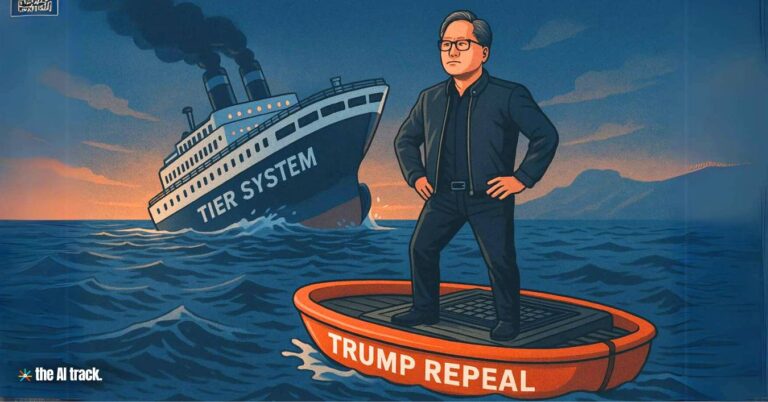

Competitive Landscape: Stargate vs. Meta

Meta plans $65B AI investment for 2025 responding to Trump’s $500 billion “Project Stargate” with OpenAI and Oracle. Elon Musk publicly undermined the initiative, claiming OpenAI “doesn’t have the money,” escalating his feud with CEO Sam Altman.

Zuckerberg acknowledged AI infrastructure “overbuilding” risks but argued the cost of falling behind outweighs short-term losses:

“Missing a major shift in computing would cost far more than a few billion in overspending.”

Global Competitors Commit $596B+

- Microsoft: $80B for AI data centers in fiscal 2025 (Brad Smith: “golden opportunity for American AI”)

- AWS: $11B Georgia expansion for cloud/AI infrastructure

- Stargate: Trump’s $500B project with OpenAI, Oracle, SoftBank, and Dubai’s MGX sovereign fund

Policy & Cultural Shifts

Post-Trump inauguration changes:

- Meta eliminated fact-checking programs and DEI initiatives

- Aligned with Trump’s AI executive order targeting “ideological bias”

- Zuckerberg: Infrastructure push will “extend American technology leadership”

Stock Volatility & Record Market Cap

Despite a 1% premarket dip, Meta shares rallied to a 0.9% gain on January 24, 2025, hitting an intraday high at $647.49 —a record high— and $1.6T market cap—up 8% year-to-date. This contrasts with a 16% drop in April 2024 when Zuckerberg warned of delayed AI monetization.

Revenue Context: Ads Fund AI Ambitions

Meta remains reliant on digital advertising, which accounts for ~98% of its 2024 revenue. The company has allocated 28 billion to AI R&D since 2023, per CNBC, with Zuckerberg stating, “We have the capital to continue investing in the years ahead.”

Upcoming Q4 2024 Earnings

Meta will report results on Jan. 29, 2025, with analysts expecting:

- $47B revenue (98% from ads)

- $6.75 EPS (both records)

Scrutiny centers on ad growth sustainability amid AI spending.

Analysts will scrutinize ad revenue sustainability amid AI spending. The company’s 2023 AI spending totaled $27 billion, highlighting a 140% increase by 2025.

Product Pipeline: Meta AI, Llama 4 & AI Engineer

Meta plans $65B infrustructure investment for 2025 targeting three core AI products:

- Meta AI Assistant: Aiming for 1+ billion users in 2025 (200M interactions in 2024)

- Llama 4: Positioned to become the “leading state-of-the-art model”

- AI Engineer: An internal code-generating tool for R&D automation

- Next-gen hardware like Ray-Ban smartglasses.

Zuckerberg aims to make Meta AI the “leading assistant” globally, surpassing rivals like Google’s Gemini and Apple’s Siri.

Zuckerberg’s Stake & Net Worth

Zuckerberg owns 13% of Meta (worth ~200B), (4th globally). His personal fortune hinges on Meta’s AI success, as ads (98% of 2024’s 134B revenue) fund the 65B AI bet.

Why This Matters

Meta plans $65B AI investment for 2025 and this aggressive spending reflects AI’s role as a “winner-takes-most” market, with implications for:

- Global Tech Sovereignty: Stargate’s inclusion of Dubai’s MGX signals international alliances, while Meta/Microsoft emphasize U.S. leadership.

- Market Consolidation: The 60B–60B–65B budget dwarfs Microsoft’s 2024 AI spend (27B) and Alphabet’s (32B), per Gartner.

- Energy Demands: 1 gigawatt of computing power raises questions about sustainability.

- Job Markets: Rural tech hubs like Louisiana could offset urban talent shortages.

- Policy Risks: Zuckerberg’s proximity to Trump’s administration (evidenced by his attendance at the Jan. 2025 inauguration) could draw scrutiny amid debates over AI ethics and antitrust regulations.

- Regulatory Risks: Trump’s recent executive order targeting “ideological bias” in AI may clash with Meta’s content moderation policies.

- Investor Sentiment: Meta’s stock dipped 2% post-announcement amid concerns over ROI timelines, per Yahoo Finance.

Everything you need to know about the AI war: Explore the competitive AI landscape and learn how leading companies and nations are shaping the future with advanced AI technologies

Read a comprehensive monthly roundup of the latest AI news!